sERVING YOUR MISSION | INVESTING & TAX STRUCTURE | RESOURCES

Private Foundation Investments & Advisory Services

We understand that board governance and oversight are essential, and we're here to help. Our expert team guides private foundations through the journey of philanthropic giving with strong financial acumen.

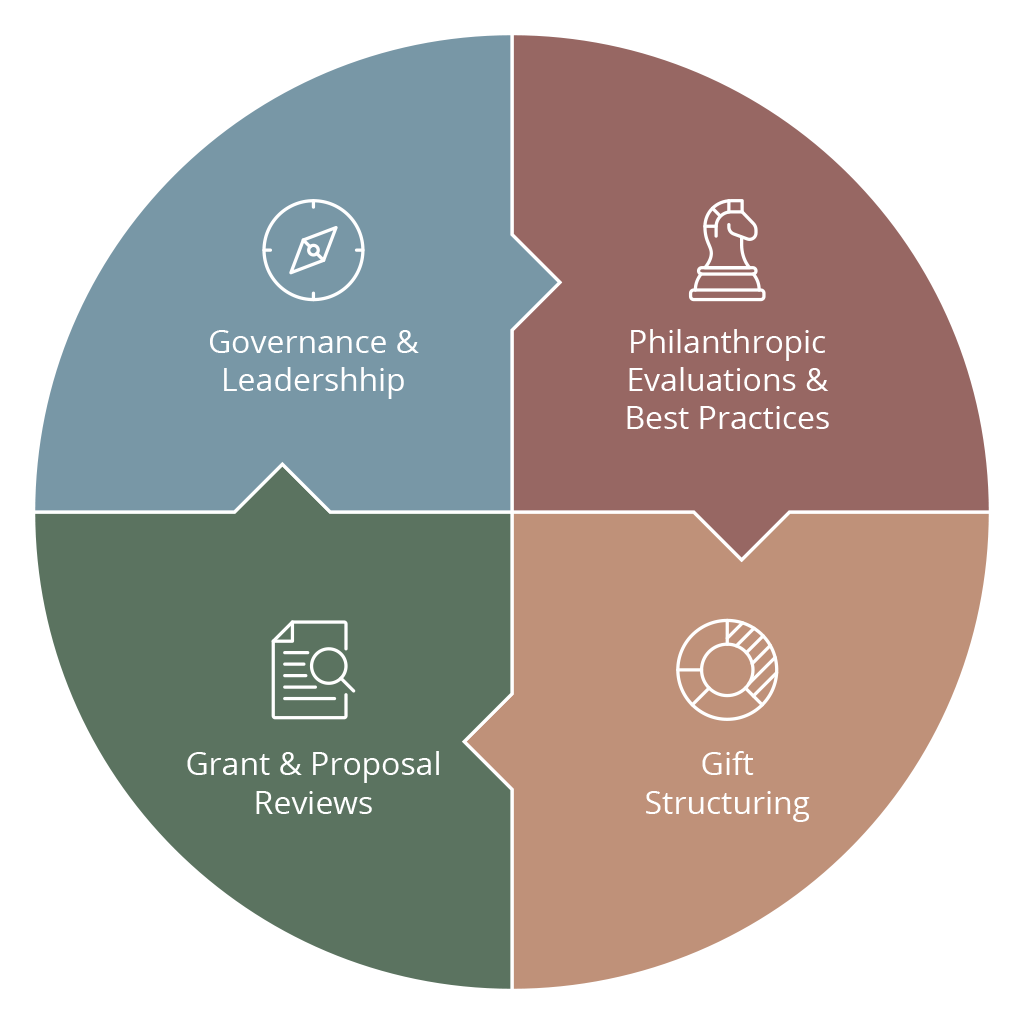

Governance and Leadership: We assist in articulating your foundation's purpose and developing evidence-based targets. We also actively monitor your portfolio's growth within a sound investment strategy framework and provide evidence-based best practice solutions that align investment strategy with your foundation goals.

Philanthropic Evaluations and Best Practices: When it comes to gifting strategies, we continuously monitor, evaluate, and refine the process. This approach is based on investment management principles to ensure your assets and impact grow in tandem.

Grant & Proposal Reviews: Collaboratively, we’ll review your grant proposals and evaluate structures and initiatives that resonate with your foundation's goals. Additionally, we help align your goals with investment management expertise to secure the financial future of your philanthropic endeavors.

Gift Structuring: Our approach optimizes tax advantages to ensure each major gift aligns with your foundation's investment objectives.

Purpose. Passion. Performance.

Strategic Philanthropy Meets Wealth Management

Our specialists help private foundations create portfolios and tailor an investment strategy that meets your foundation's goals and mission. Our stem-to-steer advisory includes:

- Crafting a mission statement and giving strategy

- Designing a tax structure that maximizes your assets

- Creating sound board governance strategies

- Integrating a holistic wealth management and investment approach to all your work

With our finger on the pulse of philanthropic trends and best practices, we can help you meet your board’s objectives and manage your assets so you can maximize efficiency and impact as you protect and grow your foundation’s legacy. Contact us to discuss your board's objectives and goals.

Your Foundation's Financial Stewardship Is Our Priority

Our investment management approach is tailored to the unique needs of private foundations, balancing the nuances of philanthropic intentions with the pragmatism of financial performance and risk management.

Impact Investing: Bridge your foundation’s financial and social objectives and explore the benefits of socially responsible investing. To us, this is not a new trend. Our investment team has deep expertise and experience guiding our clients on Impact investment strategies, and uses screening criteria tailored to align with your foundation’s values.

Not a Trade Off: You don’t need to choose between changing the world and reaching your financial goals. Our mission is to help your foundation create an impact by contributing to positive change, alongside maximizing your portfolio performance during all market cycles.

Bridging Financial and Social Goals:

Bridge your foundation’s financial and social objectives and explore the benefits of socially responsible investing. Our investment team has deep expertise guiding our clients on Impact investment strategies and use the screening criteria tailored to align with your foundation’s values while actively managing your portfolio's performance.

Tax & Compliance

501(c)(3):

We will establish your private foundation is properly structured, including essential 501(c)(3) filings and 990 and annual 990-PF, so you can focus on what truly matters—operationalizing your mission. Further our experts ensure all gift giving and legacies are following the ever-changing tax and legal landscape.