Explore the BakerAvenue Difference

Active Tax-Loss Harvesting Concentrated Stock Strategies Tactical & Tax-Enhanced Investment Management Premier Access to Alternative Investments In-House Estate, Tax Planning & Preparation*

Whether you need advice on minimizing taxes, concentrated stock strategies, alternative and real estate investments, or building their legacy, we’re here to help guide you.

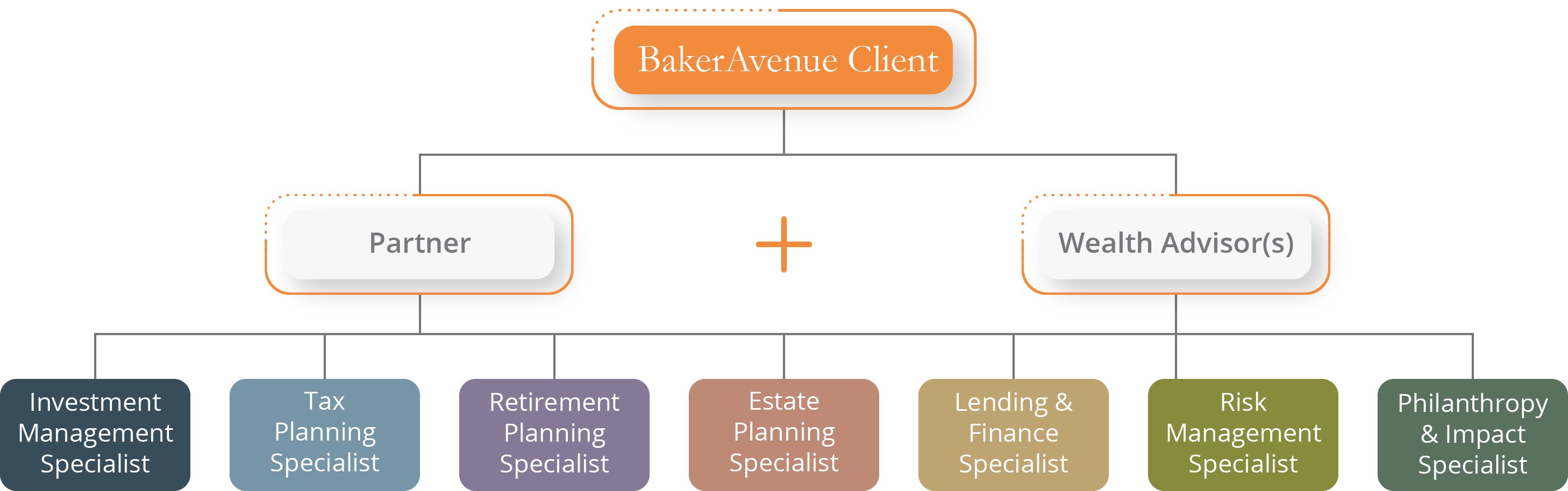

Our in-house planning experts proactively work with you to help you achieve your long-term goals. We clarify the complex and deliver an integrated, long-term solution to support your Lifestyle, Growth, and Legacy objectives.

*Tax preparation services available to those clients with $5M+ AUM managed by BakerAvenue.

.png?width=1186&height=1080&name=AUM%20$3.7B(1).png)

Our TMF Approach

"We utilize an empirically driven and evidence-based approach to managing money. Our outlook incorporates logic and theory as well as observation and experience. We believe the most compelling analyses come from harmonizing these different analytics into an efficient, repeatable process. We call it our Technical, Macro, Fundamental (TMF) approach."

Doug Couden, CFA

Chief Investment Officer & Partner

Enrolled Agents Are Standing By

Our Enrolled Agents (licensed with the highest tax credential by the IRS) can guide you in navigating the complexities of the US tax code and probates. We provide advice on tax regulations to assist you through life decisions that have tax implications.

Tax Advisory Services Include:

- Maximizing tax-deductible retirement contributions

- Planning for tax-free income in retirement

- Using lower-income years (“gap years”) between working and taking RMD distributions

- Tax-loss harvesting to minimize taxable income

- Selling an investment property tax-efficiently

- Diversifying concentrated stock portfolios tax-efficiently

- Maximizing tax benefits of charitable donations

- Strategies to tax-efficiently pass estate to heirs

Ensure Your Legacy Lasts

We'll guide you through the estate planning process to help you identify your options. We work with families to highlight structures you may want to implement or revisions given your current family dynamics, net worth, and the existing tax laws to ensure your assets are taken care of both now and in the future.

Estate Planning Services Include:

- Identifying fiduciaries and beneficiaries

- Optimizing family and asset protection and tax-efficient structures

- Utilizing gifting strategies to transfer/protect wealth and maximize exemptions

- Analyzing assets to implement income and estate tax-efficient strategies

- Planning and implementing optimal designs for life insurance, retirement, and education planning

- Determining charitable intentions during life and death

- Reviewing legislative developments as they affect your estate

Most Investors Have an Emotional Tie to Their Concentrated Stock Position

You may have embedded capital gains with a stock and may not be comfortable selling your entire position. BakerAvenue can offer specific and proactive recommendations to maximize its potential value while reducing risk.

Concentrated Stock Services Include:

- Generating income through option strategies

- Hedging the position to help protect against the potential downside

- Gifting & tax strategies to establish your legacy and offset capital gains

View our concentrated stock webpage for more information on our in-house services.

Our Concentrated Stock Strategies

Managing a concentrated stock position requires a sophisticated, integrated approach to reduce risk, optimize tax outcomes, and align with long-term goals. While many RIAs offer individual components of these strategies, BakerAvenue is unique in delivering all five under one roof, ensuring seamless coordination and execution.

Our offerings include:

- Technical & Fundamental Stock Analysis:

Integrated research blending company fundamentals with market trends to inform decisions and effectively manage concentrated positions. - In-House Tax Strategy & Filing:

Comprehensive tax-planning and filing services to ensure strategies are implemented seamlessly and aligned with your client's broader financial plan. - Trust Strategy & Advice (CRT):

Expert guidance on Charitable Remainder Trusts and other trust structures for tax benefits, estate planning, and philanthropic goals. - Long/Short Tax-Loss Harvesting:

Advanced techniques to harvest losses and offset gains, improving after-tax returns without compromising portfolio integrity. - Proprietary In-House Options Overlay:

Customized options overlays to hedge concentrated positions, manage downside risk, and potentially generate additional income. - Ordinary Income Mitigation (AQR):

Structured strategies to reduce the impact of ordinary income taxation, helping clients retain more wealth over time.

We Manage Concentrated Positions on Some of the World's Biggest Brands

Achieving Goals Through Strategic Concentrated Stock Management

"I'd like to retire": The client wanted to diversify her concentrated stock to preserve her wealth and diversify. After some profit-taking, she diversified into a balanced growth portfolio so can have a work-optional lifestyle on her way to retirement.

"I want to travel around the world...": The client plans to retire in a few years and travel the world and wants to receive income from his investments. The client wanted to diversify and preserve his wealth after IPO, and we helped him reduce his tax exposure and generate income.

“I want to buy a farm and spend my time in Asia": The client wanted to diversify to preserve her wealth while creating a work-optional lifestyle. We helped her optimize her position and reduce her taxes. She and her husband plan to buy a large farm to retire on and establish a will and trust for their children.

The images above represent client profiles, they are not the actual clients.

Access to Alternatives

BakerAvenue provides access to premier hedge funds, private equity, venture capital, and private real estate managers. We administer a stringent due diligence process to extensively review economic and market factors to evaluate our alternative manager partners.

Potential Key Benefits of Alternative Investments

- Portfolio diversification by decreasing dependence on traditional asset classes like equities and fixed income

- Potential for lower market volatility in certain alternative investments

- Optimize portfolio income and cash flow in certain alternative investments

- Exposure to other investment opportunities not found in traditional equity and fixed income markets

Bridging Social and Financial Objectives

You don’t need to choose between changing the world and reaching your financial goals. Our mission is to help you create an impact by contributing to positive change, alongside maximizing your portfolio performance during all market cycles.

Our Impact Lens Filtering Criteria:

- Environmental: Energy efficiency, greenhouse gas and emissions

- Social: Corporate diversity, gender equality, board members pay, ownership

- Governance: Anti-competitive practices corruption and instability

financial system instability

Real Estate Investor

Real estate investor who owned multiple rental properties and wanted to simplify his life. He came to us to discuss 1031 Exchanges as well as how to set up a DST and bridge a QOZ to reduce taxes.

Energy Executive

Retired energy executive who was seeking comprehensive stock analysis, concentrated stock management, access to alternative investments, and an integrated wealth and investment approach. He valued our in-house services.

Tech Executive

Tech executive who was underwhelmed with how her current advisory firm was managing her concentrated stock positions. She wanted a local team and was impressed by our covered call "Up & Out" strategy.

Trust Beneficiaries

Trust beneficiaries who were seeking expertise to address their complex situation. We offered covered call strategies to generate income and diversify concentrated positions in a tax-efficient way.

The images above represent client profiles, they are not the actual clients.

Our Insights and Impact